Tokenomics Overview

General

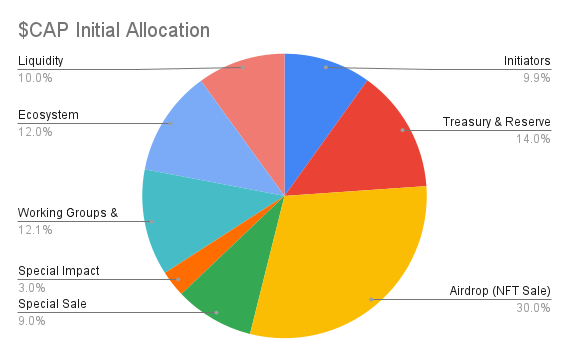

$CAP will be capneo's native token and will be issued by the capneo DAO.

Max. Supply: 10,000,000 CAP

Token Standard: ERC 20

Listing of $CAP

The capneo utility token will be listed approx. in Q4 of 2022 on Quickswap (Polygon network). The initial listing liquidity provided by capneo DAO is planned to be $750,000 worth of $CAP and $750,000 worth of $MATIC, which will account for ca. 23.5% of raised funds.

Allocation and Distribution Schedule

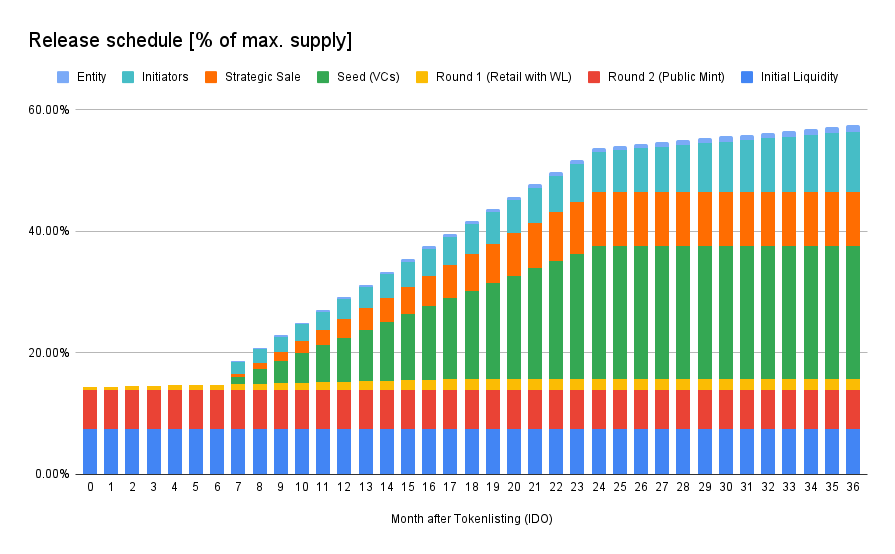

Release schedule

Strategic Membership: 6 months lock-up period after token listing, 18 months linear vesting schedule afterwards.

NFT Membership:

Seed (VCs): 6 months lockup after token listing, 18 months linear vesting afterwards

Round 1 (Retail with WL): 25% instant release. 75% linear vesting over 18 months.

Round 2 (Public Mint): No vesting

Ecosystem Grants: Distribution via successful DAO governance. But a maximum of 3.54% can be released every month. Moreover, 30% of the grant amount is instantly released, the remaining 70% are linearly vested over 6 months.

Working Groups: 10% are unlocked at listing which will be used to further distribution via successful DAO governance. Every following month, a maximum of 2.36% can be released. Moreover, 30% of the rewards a working group receives are instantly released, the remaining 70% are linearly vested over 6 months.

Liquidity: 75% unlocked at listing, the remaining 25% are reserved for market-making and subsequent CEX and DEX listings.

Treasury: 20% unlocked at the listing, afterwards 3.33% per month over 2 years. Distribution only via successful DAO governance.

Initiators & Advisors: 3-year quadratic vesting schedule, including a 6-month cliff, starting on the day of the token listing.

The following chart excludes tokens that will be controlled by governance and do not follow an unlock schedule, such as "Ecosystem & Grants", "Working Groups & Contributors" and "Treasury".

Last updated